Udaipur : HDFC Bank today took itsfestive offers to the most remote parts of the country. It launchedthe semi-urban and rural phase of ‘Festive Treats’, its annual financial services dhamakathrough the Government of India’s Common Service Centres (CSC)network.

Through thenetwork of 1.2lakh village level entrepreneurs (VLEs) enrolled with CSC, customers in these locations can avail of offers specifically created for them. Customers will get special deals on all banking products from loans to bank accounts. This includes home loans, 2-wheeler loans, car loans, tractor loans, gold loans or business growth loans.

The bank has also tapped over 3,000+ hyperlocal merchants and traders to offer customized deals at the regional level.Customers can avail of flat 5% to 15% off in various categories including apparel, electronics, grocery, home decor and jewellery among others. This is over and above 1,000+ national and international offers that can are also available.

Customers simply have to walk to their nearest Common Service Centre or neighbourhood VLE to avail ofspecial festive offers available across the spectrum of financial solutions. In the current circumstances with the pandemic, all these offers are also available online.

Both retail as well as business customers can avail of:

1) discounts on processing fees for loans,

2) reduced EMIs,

3) discounts on foreclosure charges on certain loans availed during the period

For the complete range of offers on the Festive Treat campaign, visit:

https://v1.hdfcbank.com/htdocs/common/2020/sept/festivetreat/shopping.html

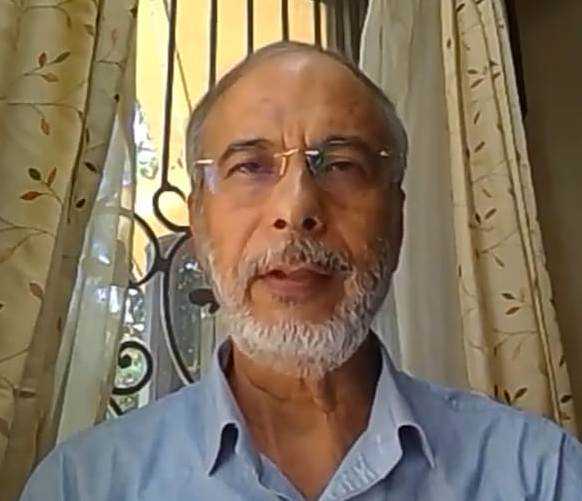

This is the 2nd phase of HDFC Bank’s Festive Treats 2.0 campaign. It was launched in digitally across the country on September 30. The rural phase of thecampaign was launched digitally by Ms.SmitaBhagat, Country Head, Government and Institutional Business, E-Commerce and Start-ups, HDFC Banktogether with Mr.Dinesh Tyagi, CEO CSC SPV. You can watch the launch address to the VLEs here:

While there are a vast number of offers available through the Festive Treats 2.0Campaign, here are a few illustrative benefitsespecially for rural India:

- Two Wheeler Loan at Zero Processing Fee. Down payment starting at Rs 1999/- and up to 25% Lower EMI for the first 6 months.

- 50% off on Foreclosure charges for Tractor Loans booked between 1st Oct to 15th Nov and up to 90% funding on Tractors

- 50% waiver in Processing Fee for Kisan Gold Loan.

“We want to help people living in rural areas and extend as much benefit of HDFC Bank’s Festive Treats to them as those in urban areas. Last year we saw great response to this initiative. While this year it is an unusual circumstance with the pandemic, I believe our VLEs will be able to safely help those in their areas with all types of finance. They will also be able to celebrate this season with many local offers curated by HDFC Bank,”said Mr. Dinesh Tyagi, CEO, CSC SPV during the launch of phase 2.

Speaking to the VLEs about the launch of Festive Treats, Ms.SmitaBhagat, Country Head, Government and Institutional Business, E-Commerce and Start-ups, HDFC Bank said, “60% of India lives in semi urban and rural areas and we have been increasingly reaching out to them through our network. Through our partnership with CSC SPV we were able to reach so many people in these markets last year and I congratulate the VLEs for the tremendous success in the previous edition of Festive Treas. With them as our partners, we have been able to go deeper into the hinterland and take banking products to rural India. We hope to continue growing together.”

In July 2018, HDFC Bank and CSC SPV signed anMoUto enable VLEs enrolled with CSCs to offer banking products and services in remote locations. The arrangement envisaged making banking services available to lakhs of people in rural India who did not have access to formal banking.