Briefing the media in New Delhi, Finance Minister informed that by next week the Centre will also disburse 25 thousand crore rupees towards Integrated GST for 2017-18 to those states that received less amount due to the anomalies.

The GST Council also recommended the extension of Levy of Compensation Cess beyond the transition period of five years which is beyond June, 2022, for such period as may be required to meet the revenue gap.

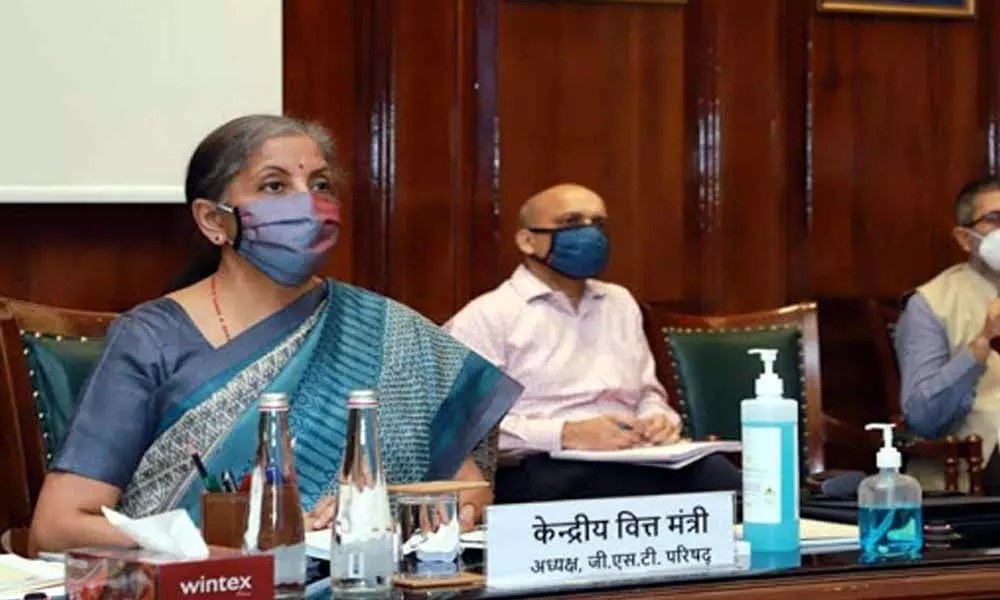

Finance Minister informed that the GST Council has deferred the decision on the mode of payment of pending GST compensation share of the states to 12th October meeting of the Council. The Minister said that about 20 to 21 states chose the option given by the Centre which allowed the states to borrow to cover the compensation shortfall. However, other states, she said, did not choose any option and wanted the Centre to borrow and pay the shortfall.

Revenue Secretary Ajay Bhushan Pandey who was also present during the media briefing informed that starting from 1st January next year, taxpayers with less than 5 crore rupees annual turnover will not be required to file monthly GSTR-1 and GSTR-3B returns. He said they will now have to file it on a quarterly basis.

The GST Council meeting on Monday was attended by Finance Ministers of all States and Union Territories.