MM Forgings is currently trading at Rs. 919.85, up by 35.75 points or 4.04% from its previous closing of Rs. 884.10 on the BSE.

The scrip opened at Rs. 916.55 and has touched a high and low of Rs. 924.00 and Rs. 914.90 respectively. So far 16 shares were traded on the counter.

The BSE group ‘B’ stock of face value Rs. 10 has touched a 52 week high of Rs. 924.00 on 18-Oct-2021 and a 52 week low of Rs. 301.00 on 30-Oct-2020.

Last one week high and low of the scrip stood at Rs.924.00 and Rs. 818.45 respectively. The current market cap of the company is Rs. 2134.29 crore.

The promoters holding in the company stood at 56.34%, while Institutions and Non-Institutions held 21.65% and 22.01% respectively.

MM Forgings’ board has considered and approved the signing of share purchase agreement and acquisition of Cafoma Autoparts. The investment would result in business synergy and enhance the current business operation of the Company and its potential expansion. Post transaction, MM Forgings will hold 100% of Cafoma Autoparts. The target company shall become a wholly owned subsidiary of MM Forgings. The board of directors of the company at its meeting held on October 15, 2021, has considered and approved the same.

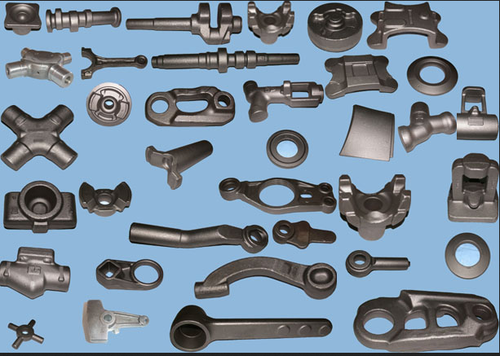

MM Forgings engages in the manufacture and sale of iron and steel forgings in India. The company offers steel forgings in raw, semi-machined, and fully machined stages in various grades of carbon, alloy, micro alloy, and stainless steels.